- Sonderberg Advisory Newsletter written by Diego Sonderberg

- Posts

- How I use fear to find bottoms

How I use fear to find bottoms

How I use fear to find bottoms

Hey,

one of the most overlooked trading edges?

Mass psychology.

Most people don’t realize how predictable the market becomes

when you understand how humans react to price.

So here’s one of the simplest tools I use to track it:

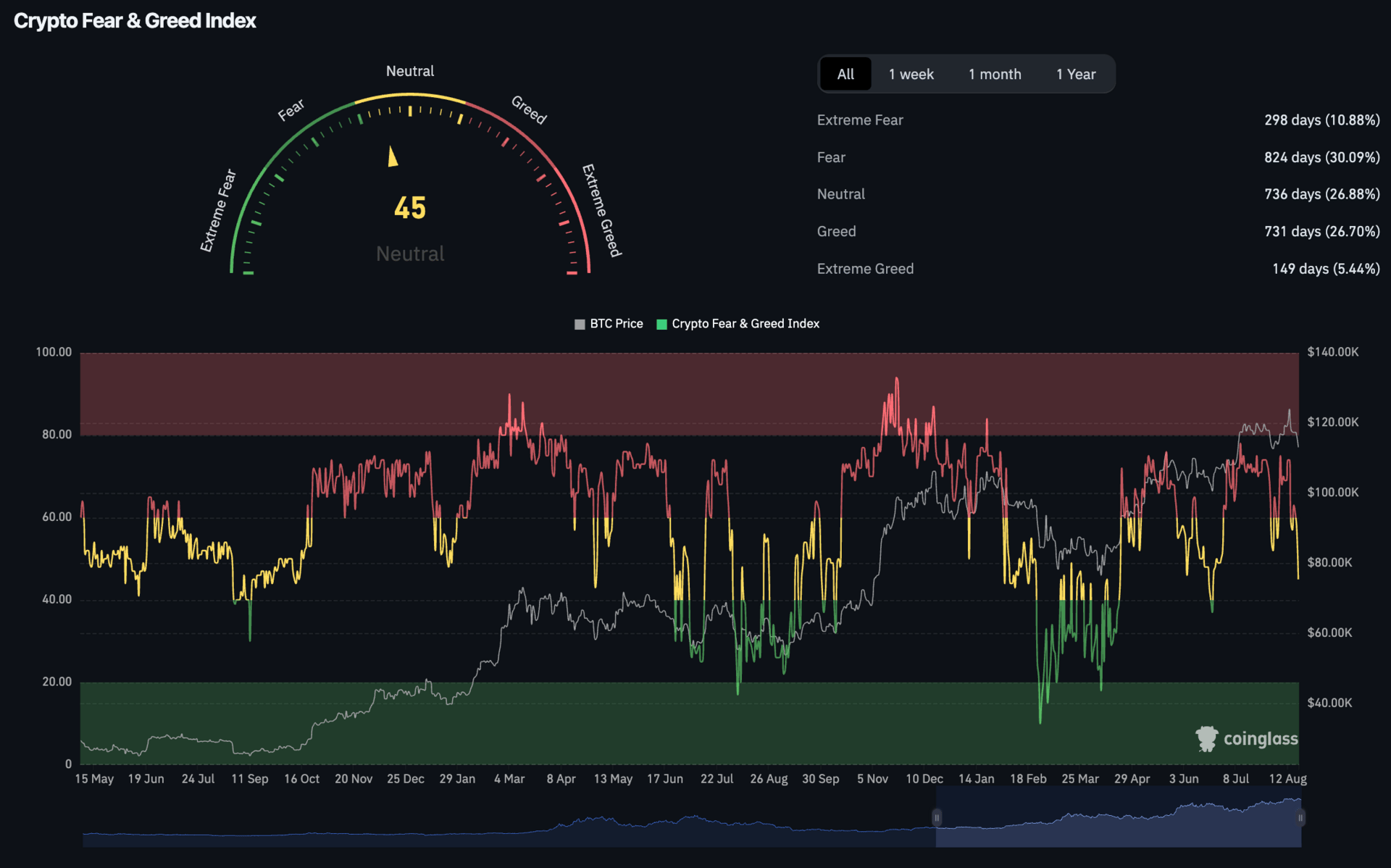

This index tracks overall sentiment using:

Volatility

Volume

Social media

Google trends

Market momentum

It shows how emotional the crowd is.

>80 = Extreme Greed → exit territory

<20 = Extreme Fear → potential bottom forming

🔁 What happened in 2024?

In April and again in Nov/Dec, the index spiked over 80.

Both times, we took profit.

Both times, corrections followed.

This is a tool I watch every single week — not to time trades perfectly,

but to understand when emotion is distorting logic.

Fear & Greed Index

You can find the indicator here: https://www.coinglass.com/pro/i/FearGreedIndex

⚠️ Important:

The Fear & Greed Index isn’t a signal by itself.

But when it lines up with:

RSI divergences

Major resistance

Funding & OI extremes

…it becomes incredibly powerful.

This is how you go from hoping to executing with conviction.

Next week, I’ll show you one of my favorite advanced confluence tools —

an indicator that’s nailed multiple tops and bottoms in this cycle.

Talk soon,

Don Diego

Founder, Velaris Trading

Reply