- Sonderberg Advisory Newsletter written by Diego Sonderberg

- Posts

- Sonderberg Market Outlook

Sonderberg Market Outlook

Brought to you by Diego Sonderberg

Sonderberg Market Outlook

Markets head into the Christmas period with thinning liquidity, Bitcoin stabilizing on emerging bullish divergences, and equities beginning to feel the weight of a broader macro cooldown.

Market Review and Forward Outlook

Bitcoin

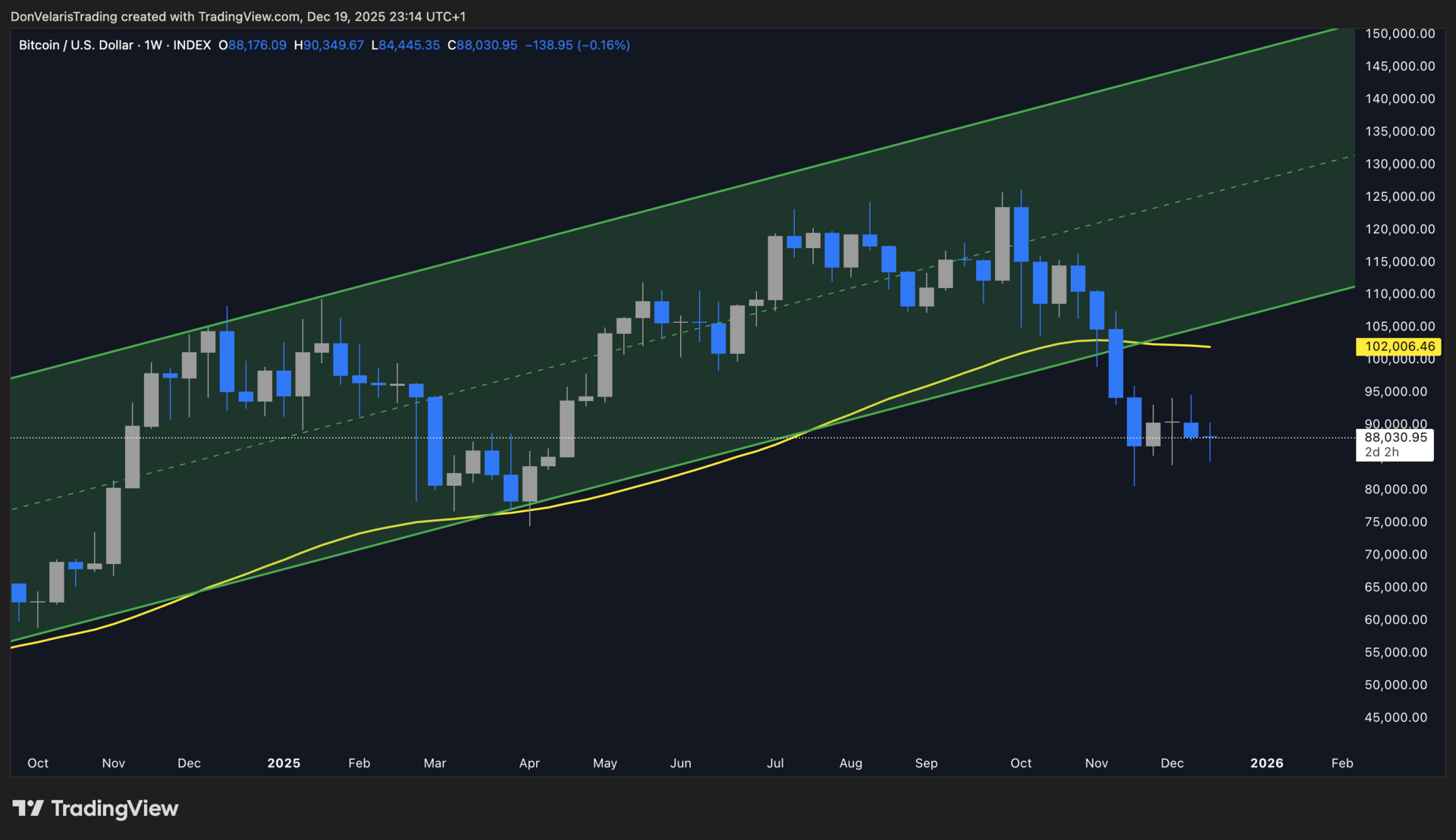

Given the low volume environment this week, Bitcoin price action remained choppy on the lower time frames and is likely to stay that way through Christmas and New Year. Most proprietary trading firms and financial institutions reduce activity during this period, which leaves order books thin and makes it easier for market makers to hunt liquidity on both sides of the market.

From a macro perspective, nothing has changed for Bitcoin. A 3D bullish divergence formed mid week, something I have been anticipating for weeks. This supports higher prices over the coming weeks, although the divergence could still extend lower into the low 80K area before fully playing out. I entered around 85K with a small position, positioning for a move back toward a retest of the 50 week moving average above 100K. In addition, a 4H bullish divergence formed within the broader 3D divergence last night, offering a more refined lower time frame entry.

BTC 3D Chart

The main risk to Bitcoin and the 3D bullish divergence remains the broader equity market, particularly the S&P 500. The index has begun reacting to its own 3D bearish divergence and has already declined roughly 1 percent in recent days. On Bitcoin, the monthly open at 90.3K and the yearly open near 94K remain key short term resistance levels, while the 102K region continues to act as major macro resistance tied to the 50 week moving average.

BTC 1 Week Chart

Given the holiday period and low liquidity, I do not expect significant movement next week. I strongly advise against trading futures in this environment, as thin liquidity allows market makers to liquidate participants with ease.

With the confirmed 3D bullish divergence on Bitcoin and a simultaneous 3D bearish divergence on USDT dominance, a move into the 102K to 107K region appears more likely than at any point over the past several weeks.

S&P 500

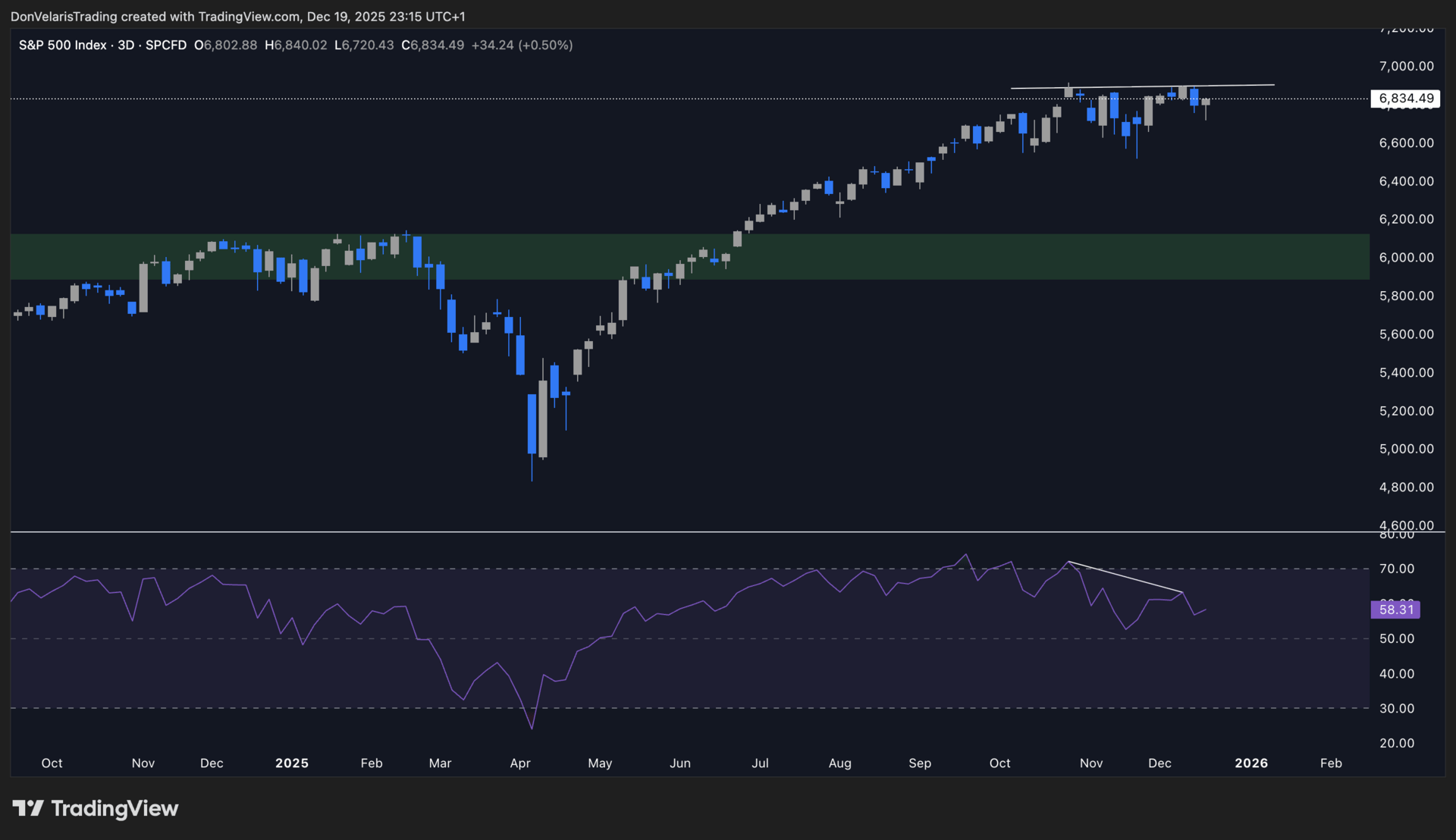

The S&P 500 had a negative week after confirming a 3D bearish divergence, a development I have been highlighting well in advance. While it is difficult to predict short term price action during a holiday week, even with upcoming economic data, the broader setup suggests limited upside and rising downside risk.

Looking into next year, the structure increasingly supports a deeper correction. A move below 6500 appears likely, and a decline toward the 6000 region would represent a strong long term buying opportunity. As equity volatility increases, spikes in the VIX should be expected.

SPX 3D Chart

Economic Data Recap

This week’s economic data reinforced a picture of cooling but still resilient growth in the United States. Inflation continued to moderate, the labor market showed gradual softening, and growth expectations edged slightly lower. None of the releases materially altered Federal Reserve policy expectations.

Consumer price inflation surprised to the downside. Headline CPI slowed to 2.7% versus 3.1% expected, while core CPI eased to 2.6% versus 3.0%. This marked the largest decline in inflation in 9 months. Markets reacted cautiously due to missing components in the Bureau of Labor Statistics release. Treasury yields initially declined before stabilizing as investors focused on the broader disinflation trend.

Labor market data pointed to incremental softening. The unemployment rate increased to 4.6% versus 4.4% expected, driven in part by higher labor force participation. Nonfarm Payrolls were mixed, with October revised lower and November rebounding modestly above expectations. Wage growth continued to cool, with average hourly earnings rising only 0.1% month over month.

Growth indicators remained constructive. Retail sales were flat at the headline level, but underlying demand was stronger, with control group sales rising 0.8%. The Atlanta Fed GDPNow estimate for Q3 growth was revised slightly lower to 3.5%, reflecting modest slowdowns in consumer spending and inventories rather than a sharp loss of momentum.

On the global front, policy divergence continued to widen. The Bank of Japan raised rates by 25 basis points to 0.75%, the highest level in 30 years, extending its normalization cycle amid persistent inflation pressures. In contrast, expectations for Federal Reserve rate cuts were largely unchanged, with markets still not pricing near term easing despite softer inflation and labor data.

Overall, disinflation and rising unemployment are progressing gradually, but not at a pace that would force immediate action from the Federal Reserve. Diverging central bank paths remain a dominant theme for rates, currencies, and global liquidity heading into the new year.

Looking Ahead

With Christmas approaching, the coming week is expected to be quiet, with thinner liquidity as many market participants step back for the holidays. This can lead to choppy price action but limits the likelihood of sustained, fundamental driven moves.

The US economic calendar is light and unlikely to materially change the current macro narrative. Recent themes of gradual disinflation, modest labor market cooling, and resilient but slowing growth should remain intact, leaving Federal Reserve policy expectations largely unchanged.

Seasonally, a Santa Claus rally is possible into year end, but any such move would be speculative given thin liquidity and the lack of meaningful macro catalysts.

Calendar

Monday (Dec. 22)

Economic: no reports

Earnings: Bright Minds Biosciences Inc. (DRUG), Ennis Inc. (EBF)

Tuesday (Dec. 23)

Economic: Capacity Utilization, Durable Orders, Q3 GDP Advanced Reading, Industrial Production, New Home Sales

Earnings: Bridgeline Digital Inc. (BLIN), Limoneira Co. (LMNR)

Wednesday (Dec. 24)

Economic: Continuing Claims, EIA Crude Oil Inventories, EIA Natural Gas Inventories, Initial Claims, MBA Mortgage Applications Index

Earnings: no reports

Thursday (Dec. 25)

Christmas Day: Merry Christmas and God bless you!

Friday (Dec. 26)

Economic: no reports

Earnings: Citius Pharmaceuticals Inc. (CTXR), Outlook Therapeutics Inc. (OTLK)

Invitation

If you manage a 6-figures or more portfolio, missed the top and want clarity with a structured timing system, make sure to book a 1:1 diagnosis call with me. I will go through your portfolio and situation and see how I can help you.

Book 1:1 call with me here: Strategy Call

Wishing you all a Merry Christmas with your loved ones,

Diego Sonderberg

Share this Outlook:

If you find these insights valuable, please share this newsletter with anyone who follows crypto or global markets. Since 2021 I’ve consistently identified major cycle tops and bottoms and aim to make this the most useful market-timing letter you read each week.

Share the following link with friends and family: https://newsletter.sonderbergadvisory.com/

Learn more:

YouTube Channel

X Account

Reply