Sonderberg Market Outlook

With Bitcoin threatening its first lower low of the cycle and the Dollar breaking higher, markets are sending signals you cannot afford to ignore.

Market Recap

Bitcoin is likely closing another weekly candle below the 50 week moving average and 100K, signalling that the bull market has likely ended and that a deeper corrective phase is underway. Price fell from 94K to 80K during the week before stabilizing near 84K, while the weekly structure now risks forming the first lower low of the entire cycle. The weekly RSI is nearing oversold levels, but no macro or technical reversal signals have appeared so far. The Dollar Index broke above 100 and continues to trend higher, adding pressure to both equities and crypto. The S&P 500 slipped from 6713 to 6602 despite strong Nvidia earnings, and mixed labour market data reinforced a cautious tone across risk assets.

Economic Data

Nonfarm Payrolls for September increased by 119,000, significantly above the 51,000 expected. However, August was revised sharply lower from 22,000 to negative 4,000, which offsets part of the surprise. The unemployment rate rose to 4.4%, slightly above the 4.3% forecast, likely due to a higher participation rate. The overall picture of the labor market is mixed. The University of Michigan Consumer Sentiment Index for November increased to 51.0 from 50.3, but remains extremely low. It is the second lowest reading on record. Inflation expectations for the year ahead eased slightly to 4.5%, marking the third consecutive monthly decline. Longer-term inflation expectations fell from 3.9% to 3.4%. Initial jobless claims fell to 220,000 for the week ending November 15, slightly below expectations, while continuing claims rose to 1.957 million, the highest level in four years. This combination suggests softening conditions beneath the surface.

The Coming Week and What I Look For

Bitcoin Outlook

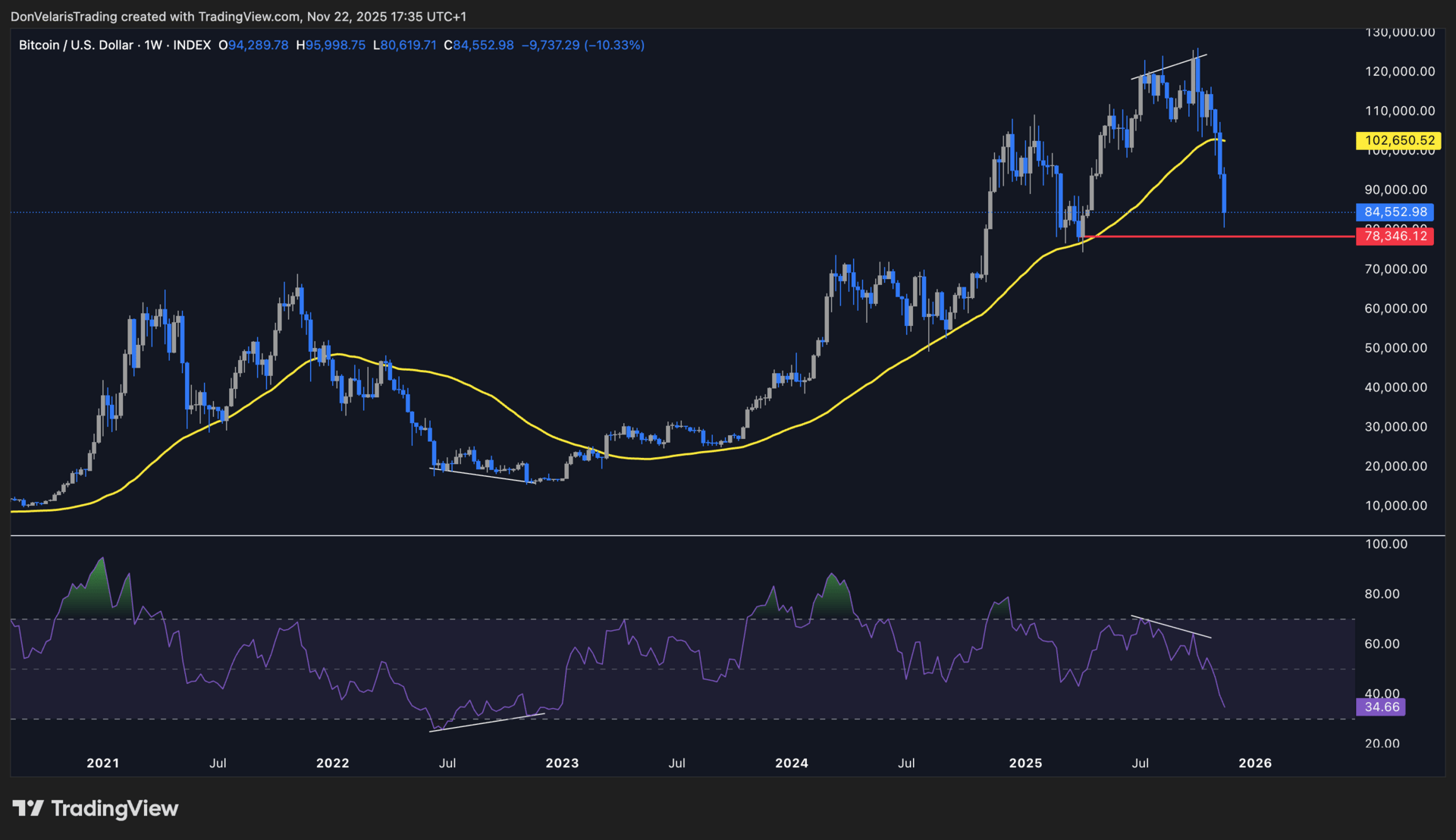

Bitcoin enters the new week under significant pressure after last week confirmed a major structural break. Earlier this month Bitcoin closed its first weekly candle below the 50 week moving average, a level that supported the entire bull market since 2023. With last week’s continuation to the downside, the probability increases that the market has already shifted into a deeper corrective phase that will extend through next year.

Last week Bitcoin fell from around 94K to 80K before finding temporary support. It is currently trading near 84K. This move sliced through every major support level and highlighted how weak spot and derivative flows have become. For the coming week the key structural level remains 78.5K. A weekly close below this level would confirm the first lower low of this entire cycle and would strongly support the bear market thesis.

BTC Weekly Chart

If Bitcoin retests the 50 week moving average from below, it would likely act as bearish resistance. Historically this retest often appears before the next leg lower and would offer a profit taking zone for anyone who has not sold higher at 120K.

The weekly RSI is approaching oversold conditions. In previous bear markets the RSI remained oversold for long periods while price continued falling. A meaningful long term buy signal requires a bullish divergence on the weekly timeframe combined with several bottom indicators. None of these are present yet. My current timing expectation for the next cycle bottom is between 40K and 60K sometime in September or October 2026, with 30K possible in a severe scenario. These levels are projections only. The real buy signal will come from the bottom indicators themselves, regardless of price.

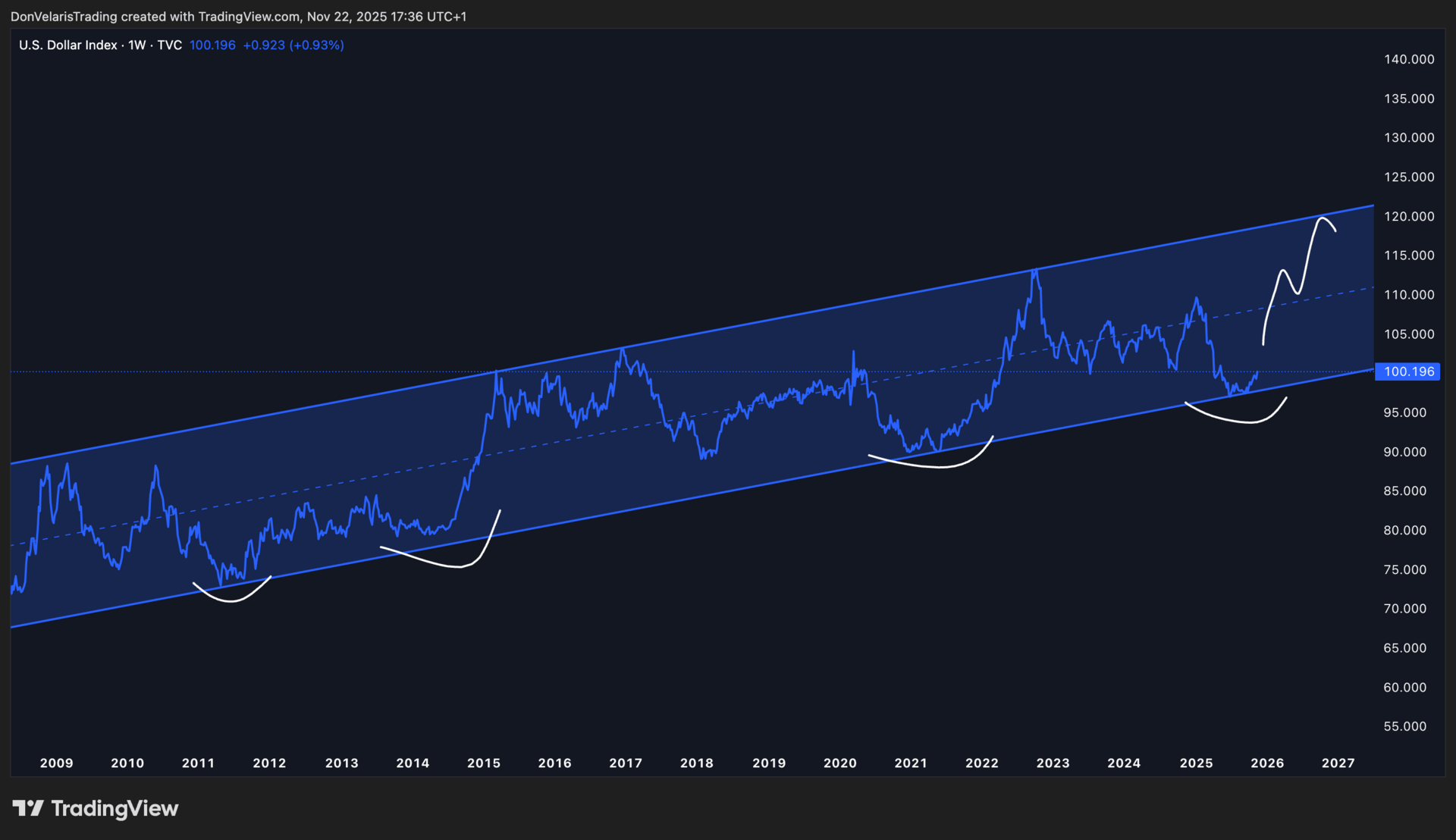

Dollar Outlook And Influence On Markets

The Dollar Index continued its recovery last week and broke above 100, creating broad pressure on both traditional markets and crypto. This move fits the view that the Dollar likely bottomed weeks ago and is trending higher into 2027 as capital seeks safety.

For the coming week the focus stays on whether the Dollar builds acceptance above 100. If it continues toward 105 and 110 within the broader channel, risk assets will face consistent headwinds. A drop back below 100 could allow Bitcoin to stage a relief rally before making new lows, but so far the trend remains firmly to the upside.

DXY Weekly Chart

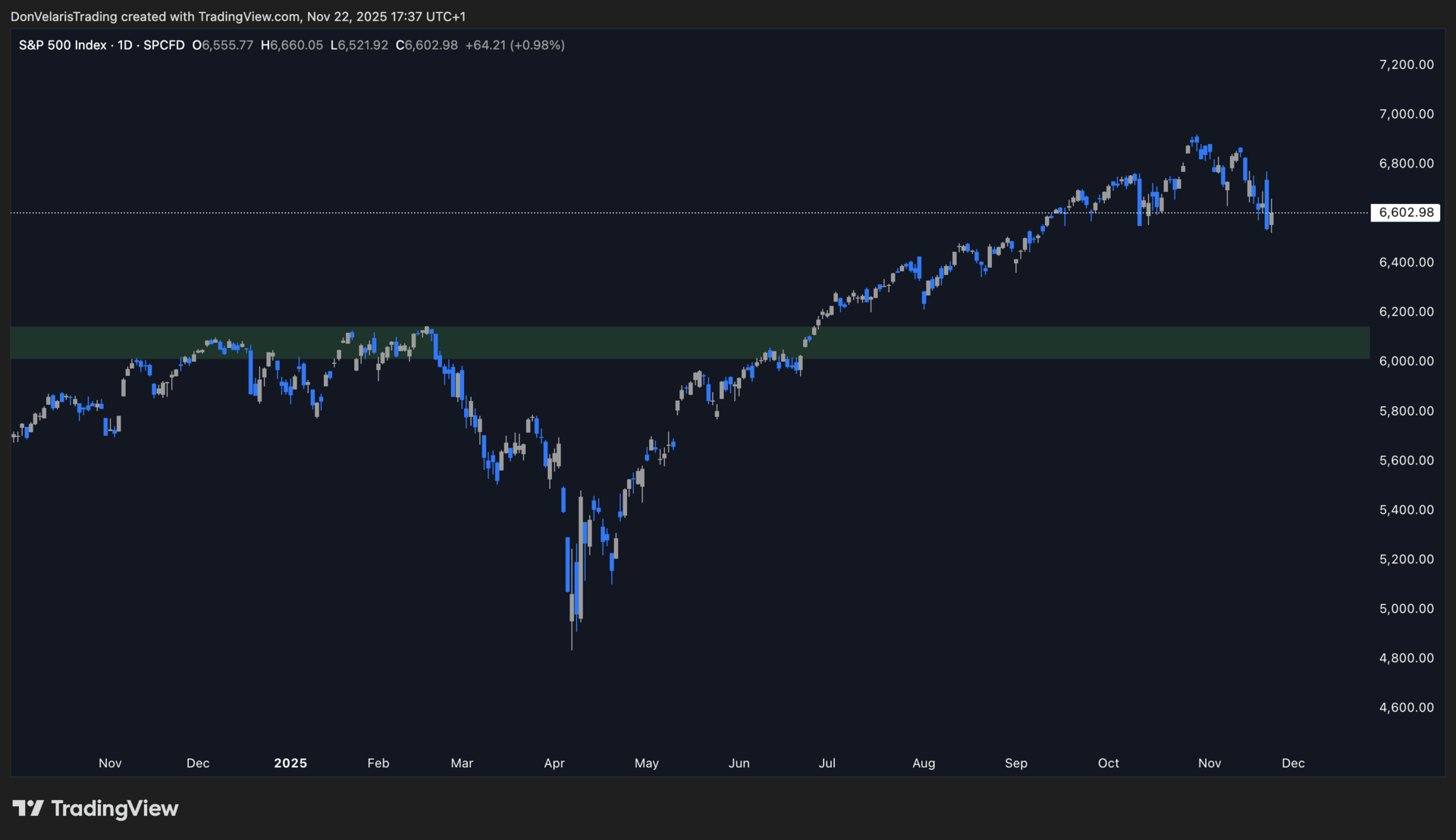

S&P 500 Outlook

The S&P 500 also printed a weak week. It opened at 6,713 and closed at 6,602 while concerns around an AI driven bubble increased. Even Nvidia’s earnings beat failed to lift the index, which shows how fragile sentiment has become.

For the coming week the market remains vulnerable. If selling pressure continues, the green demand zone below becomes the first area of interest for accumulation. Until sentiment stabilizes, equities will likely remain sensitive to any Dollar strength and to any risk off flows from institutional players.

SPX Daily Chart

Calendar

Monday (Nov. 24)

Economic: no reports

Earnings:Agilent Technologies (A), Amentum Holdings (AMTM), Corporacion America Airports (CAAP), Keysight Technologies (KEYS), Semtech (SMTC), Symbotic (SYM), Woodward (WWD), Zoom Communications (ZM)

Tuesday (Nov. 25)

Economic: Consumer Confidence, Producer Price Index PPI, FHFA Housing Price Index, Pending Home Sales, S and P Case-Shiller Home Price Index

Earnings: Alibaba (BABA), Analog Devices (ADI), Autodesk (ADSK), Best Buy (BBY), Burlington Stores (BURL), Dell Technologies (DELL), Dick's Sporting Goods (DKS), NetApp (NTAP), NIO (NIO), Workday (WDAY), Zscaler (ZS)

Wednesday (Nov. 26)

Economic: Advertised International Trade in Goods, Advanced Retail Inventories, Advanced Wholesale Inventories, Chicago PMI, Durable Orders, EIA Crude Oil Inventories, Q3 GDP Second Estimate, MBA Mortgage Applications Index, New Home Sales, PCE Prices, Personal Income, Personal Spending, Continuing Claims, EIA Natural Gas Inventories, Initial Claims

Earnings: Banco Macro (BMA), CMB Tech (CMBT), Deere and Co. (DE), Ehang (EH), Li Auto (LI)

Thursday (Nov. 27)

Economic: no reports

Earnings: no reports

Friday (Nov. 28)

Economic: no reports

Earnings: no reports

Invitation

If you manage a 6-figures or more portfolio, missed the top and want clarity with a structured timing system, make sure to book a 1:1 diagnosis call with me. I will go through your portfolio and situation and see how I can help you.

Book here: Diagnosis Call

Kind regards,

Diego Sonderberg