Sonderberg Market Outlook

Despite heavy macro damage, Bitcoin’s structure has narrowed to two outcomes a relief rally toward 100K or the confirmation of deeper lows that define the next phase of the cycle.

Market Recap

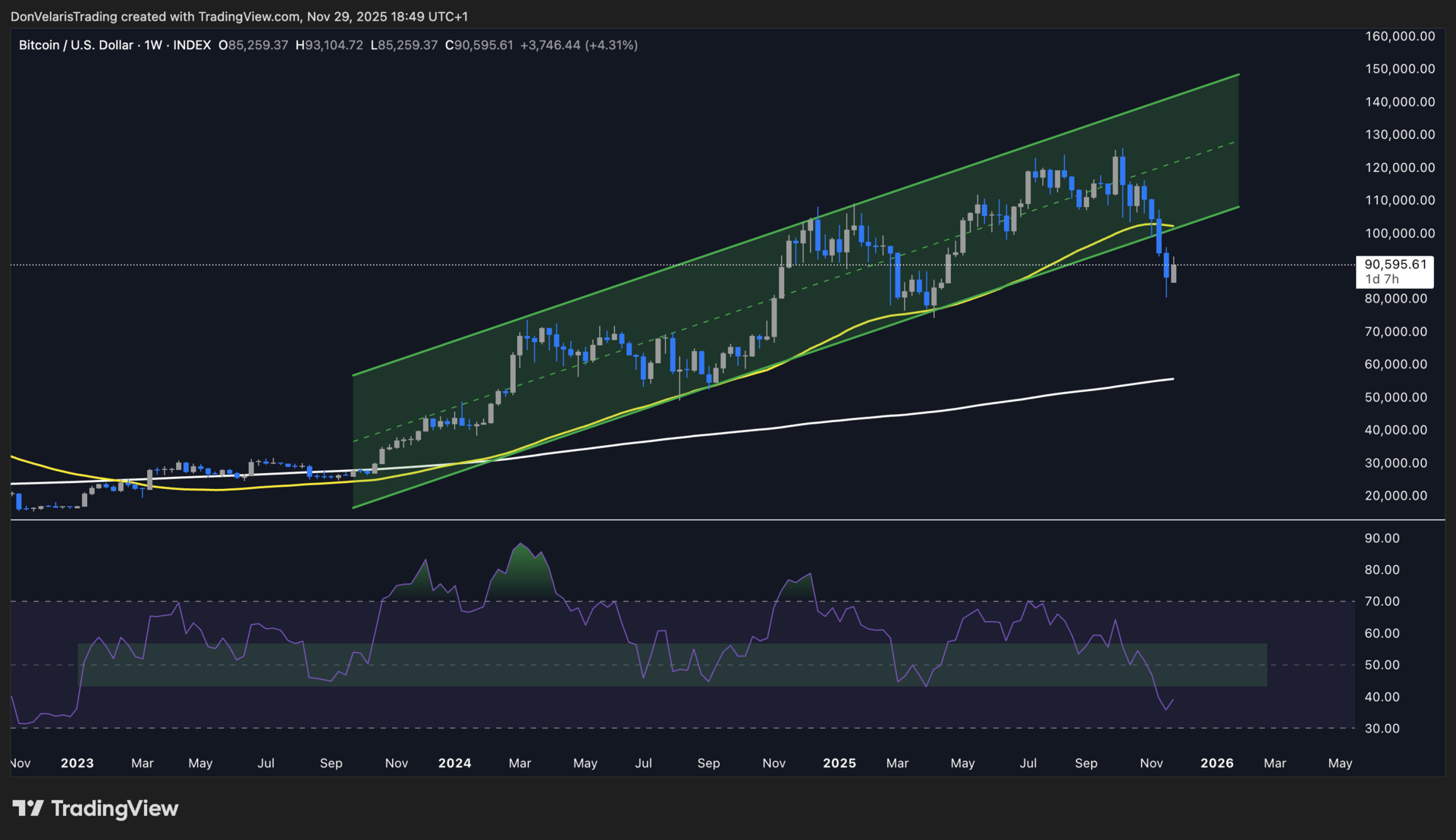

Bitcoin spent the week under heavy macro pressure, posting nearly three consecutive weekly closes below the 50-week moving average, falling under 100K, and breaking out of the parallel channel that guided the entire cycle. The weekly RSI dropped below its cycle support of 44, confirming a shift into a corrective structure. On lower time frames Bitcoin bounced sharply from the 80K area and attempted to push into the 90K to 94K resistance area, but there is still no evidence that 80K marked a macro bottom. More in the market outlook.

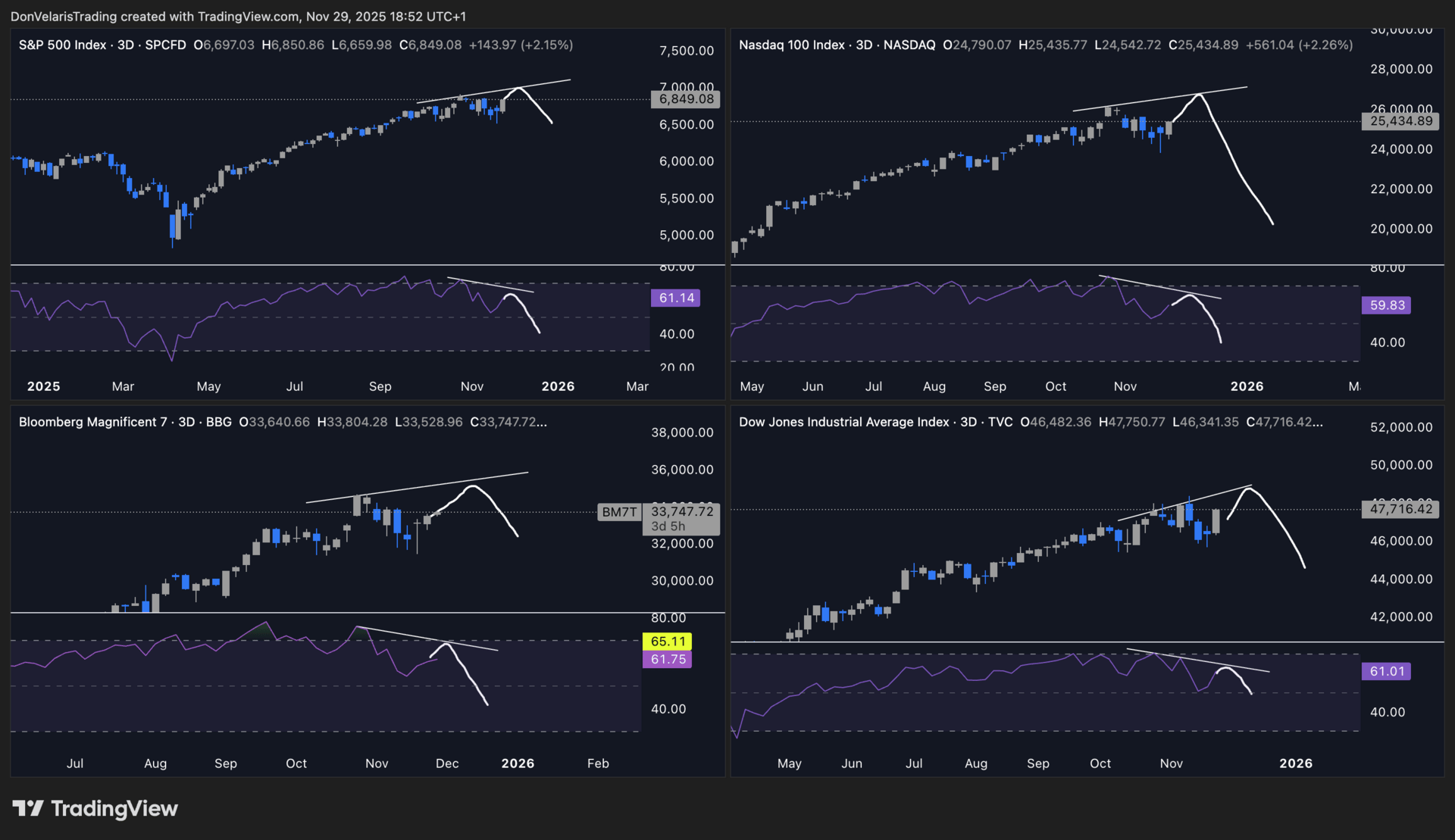

Traditional markets had a shortened Thanksgiving week yet closed strong, with major indices pushing toward new all time highs despite early signs of cooling momentum, including lower highs on RSI while price printed higher highs. The S&P 500, Nasdaq, Dow Jones and the Bloomberg MAG7 Index all approached a 3D bearish divergences, while the VIX eased and gold saw a strong week. Bitcoin’s relief move was supported by the Dollar Index rejecting the 100 level, keeping risk assets stable for now.

Economic Recap

There was limited economic data this week due to the Thanksgiving holiday. Target rate probabilities for the December 10th Federal Reserve meeting have shifted toward an 86% likelihood of a 25 basis point rate cut.

The September Producer Price Index rose to 2.7%, in line with expectations. Core PPI fell slightly to 2.6%, below the 2.7% consensus. Inflation in producer prices remains less concerning than the continued weakening in the labor market.

PCE data, one of the most important indicators for the Federal Reserve, was delayed once again due to the earlier shutdown and reporting backlog.

Overall the economic calendar was very light, but the broader picture remains one of slowing momentum and growing pressure in key labor metrics.

The Coming Week and What I Look For

Bitcoin

Bitcoin continues to show significant macro damage. The asset is about to produce it’s third consecutive weekly closes below the 50-week moving average, a level that supported the entire bull market since 2023. With this breakdown it has also closed below 100K and fallen outside the parallel channel that guided the whole cycle. The weekly RSI has dropped below its cycle support of 44, which further confirms that the macro structure has shifted from bullish to corrective.

Bitcoin 1 Week Chart

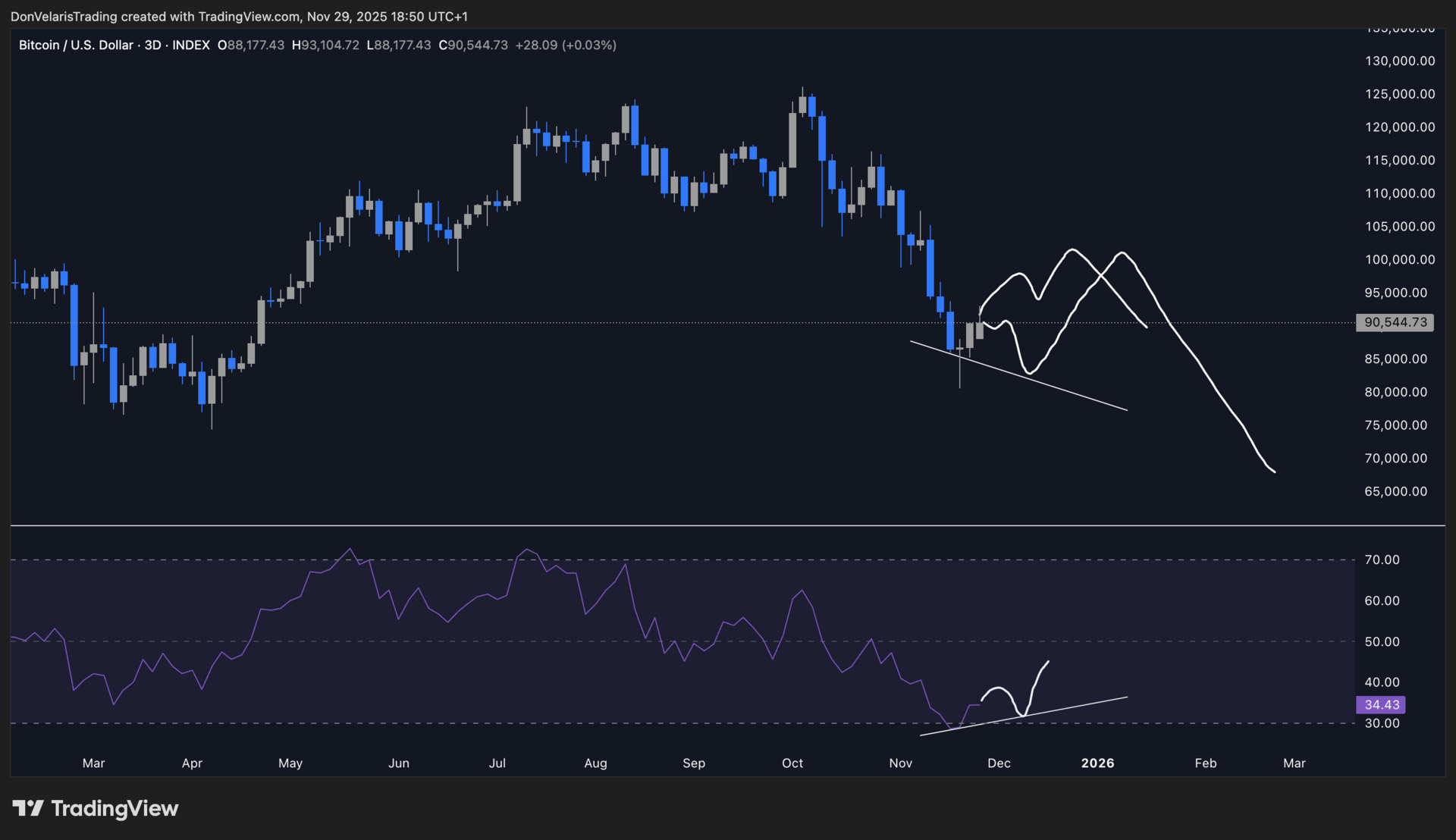

On the lower time frames the picture looks more constructive. Bitcoin rejected strongly from the 80K zone and is attempting to push above the resistance cluster between 90K and 94K. This creates two clear scenarios for the coming weeks.

In the first scenario Bitcoin rejects at the 94K region and forms a high time frame bullish divergence below 84K before attempting a move back to the 50-week moving average. A bullish divergence of this magnitude could form on the three day chart or even higher, and Bitcoin has several weeks of time to build such a signal.

In the second scenario Bitcoin successfully reclaims 94K and moves toward the 50-week moving average, only to fail there and produce lower lows, which would reset the weekly RSI. This would bring Bitcoin much closer to its cycle bottom.

Bitcoin 3D Chart

At this stage I do not see evidence that 80K is the bottom. Historically Bitcoin bottoms after retesting the 200-week moving average or after forming a clean weekly bullish divergence. Neither of these has happened yet. My expectation remains that Bitcoin will bottom between 40K and 60K, likely in October 2026, roughly one year after the cycle top, which fits the timing of previous cycles.

Traditional Markets

Traditional markets had a shortened week due to Thanksgiving. Despite the light schedule the market closed the week strong and appears positioned to attempt new all time highs next week.

The macro outlook, however, is beginning to shift. Major indices are showing cooling momentum, with the RSI forming lower highs while price forms higher highs. This does not immediately imply a correction, but it is one of the first early signals of a broader market cooldown. Divergences tend to be less reliable in traditional markets than in crypto, but they are still worth tracking.

The S&P 500, Nasdaq, Dow Jones and the Bloomberg MAG7 Index are all close to forming three day bearish divergences in the coming weeks. These would be the first three day bearish divergences since February. As history shows, this does not require an immediate reversal. Last year the first divergence printed in September, but the RSI kept making lower highs while price made higher highs all the way into February before the correction began.

S&P 500, Nasdaq, Dow Jones and the Bloomberg MAG7 Index 3D Chart

I remain attentive to this because next year is historically a mid-term cooling year and I expect a correction to develop during that period.

After several weeks of uncertainty caused by earnings season and the extended government shutdown, the VIX has eased, which has supported the recent rise in equities. Gold had a strong week as well and is potentially on its way to new all time highs.

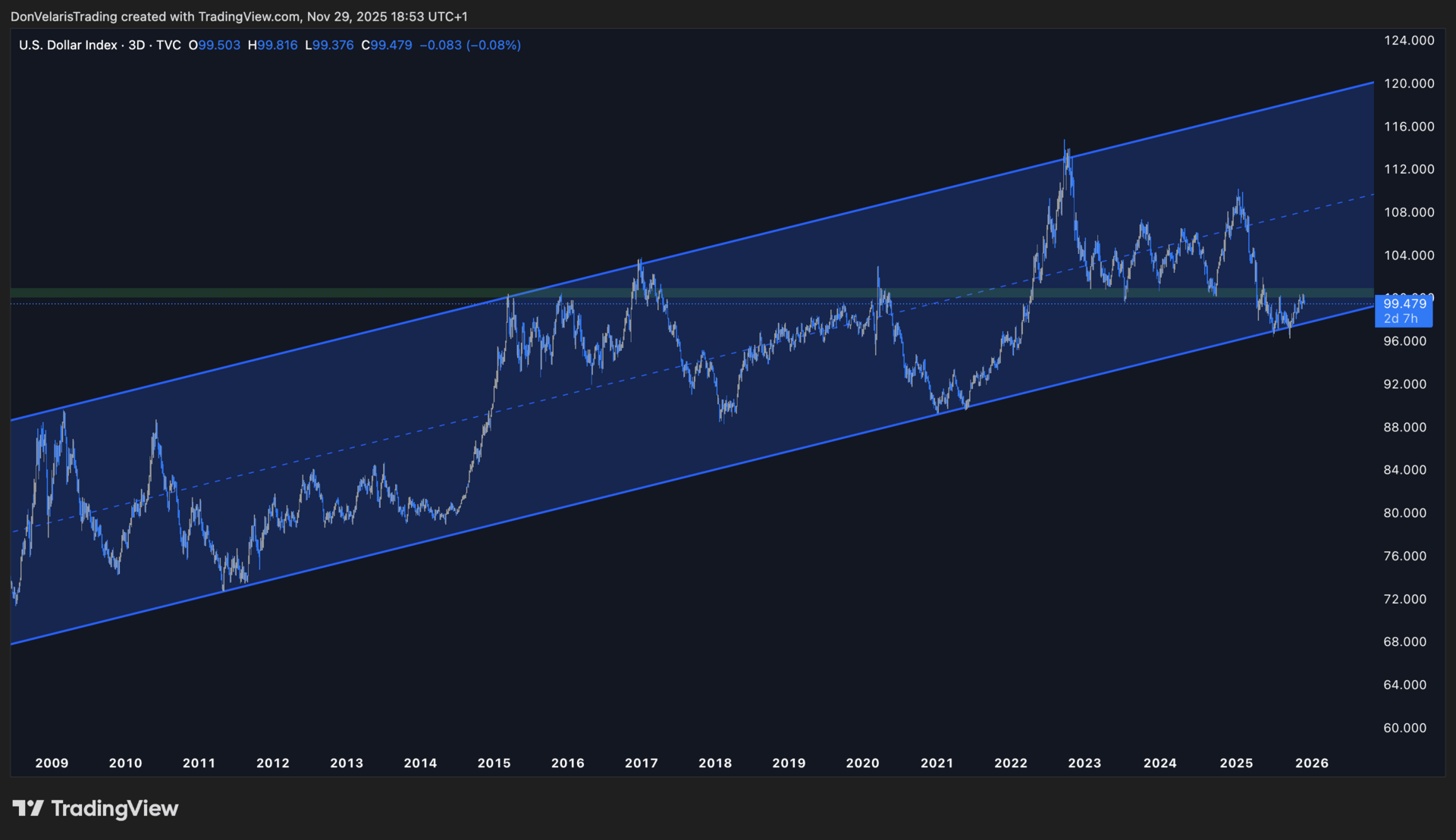

DXY - US Dollar Index

Bitcoin’s recent relief move was made possible by the rejection of the Dollar Index at the 100 level. Throughout this cycle we have monitored the DXY closely, because it tends to move inversely to risk assets. The Dollar bottomed earlier this year at the parallel channel’s range lows, which aligned with my expectation that the top was in for Bitcoin. Combined with divergences and additional cycle signals, this triggered my decision to sell all crypto near the top and open shorts.

My expectation is that the DXY will trend higher into 2026, but before that it must reclaim and hold above 100. As long as the index trades below 100, risk assets retain the possibility of pushing higher. A clean break above 100 would increase the probability of continued pressure on Bitcoin and equities.

DXY 3D Chart

Calendar

Monday (Dec. 1)

Economic: ISM Manufacturing PMI

Earnings: Hafnia Limited (HAFN), Tharisa Plc (TIHRF), Cango Inc. (CANG), MongoDB Inc. (MDBR), Simulations Plus Inc. (SLP), Vestis Corporation (VSTS), Credo Technology Group Holding (CRDO)

Tuesday (Dec. 2)

Economic: no reports

Earnings: CrowdStrike Holdings Inc. (CRWD), Bank Nova Scotia Halifax Pfd 3 (BNS), Marvell Technology Inc. (MRVL), Pure Storage Inc. (PSTG), Okta Inc. (OKTA), GitLab Inc. (GTLB), Box Inc. (BOX), Signet Jewelers Limited (SIG), American Eagle Outfitters Inc. (AEO), Asana Inc. (ASAN)

Wednesday (Dec. 3)

Economic: ISM Service PMI

Earnings: Salesforce Inc. (CRM), Royal Bank of Canada (RY), Royal Bank of Canada Montreal (RYLBF), Industria de Diseno Textil Inditex (IDEXY), Industria de Diseno Textil Inditex (IDEXF), Snowflake Inc. (SNOW), National Bank of Canada (NTIOF), Dollar Tree Inc. (DLTR), Guidewire Software Inc. (GWRE), Five Below Inc. (FIVE), HealthEquity Inc. (HQY), UiPath Inc. (PATH), The Descartes Systems Group Inc. (DSGX), Macy's Inc. (M), Thor Industries Inc. (THO), PVH Corp. (PVH)

Thursday (Dec. 4)

Economic: no reports

Earnings: Toronto Dominion Bank (TD), Bank of Montreal (BMO), Canadian Imperial Bank of Commerce (CM), Kroger Company (KR), Hewlett Packard Enterprise Company (HPE), Ulta Beauty Inc. (ULTA), Dollar General Corporation (DG), Samsara Inc. (IOT), The Cooper Companies Inc. (COO), DocuSign (DOCU)

Friday (Dec. 5)

Economic: Core PCE Price Index MoM, Michigan Consumer Sentiment Prel, Personal Income MoM, Personal Spending MoM

Earnings: Victorias Secret and Co (VSCO)

Invitation

If you manage a 6-figures or more portfolio, missed the top and want clarity with a structured timing system, make sure to book a 1:1 diagnosis call with me. I will go through your portfolio and situation and see how I can help you.

Book 1:1 call with me here: Diagnosis Call

Kind regards,

Diego Sonderberg

Share this Outlook:

If you find these insights valuable, please share this newsletter with anyone who follows crypto or global markets. Since 2021 I’ve consistently identified major cycle tops and bottoms and aim to make this the most useful market-timing letter you read each week.

Share this link: https://newsletter.sonderbergadvisory.com/

Learn more:

YouTube Channel

X Account