Sonderberg Market Outlook

Bitcoin is breaking every major structural level, yet the market now sits at a crossroads between a short squeeze toward 100K and the next decisive leg into lower lows.

Market Recap

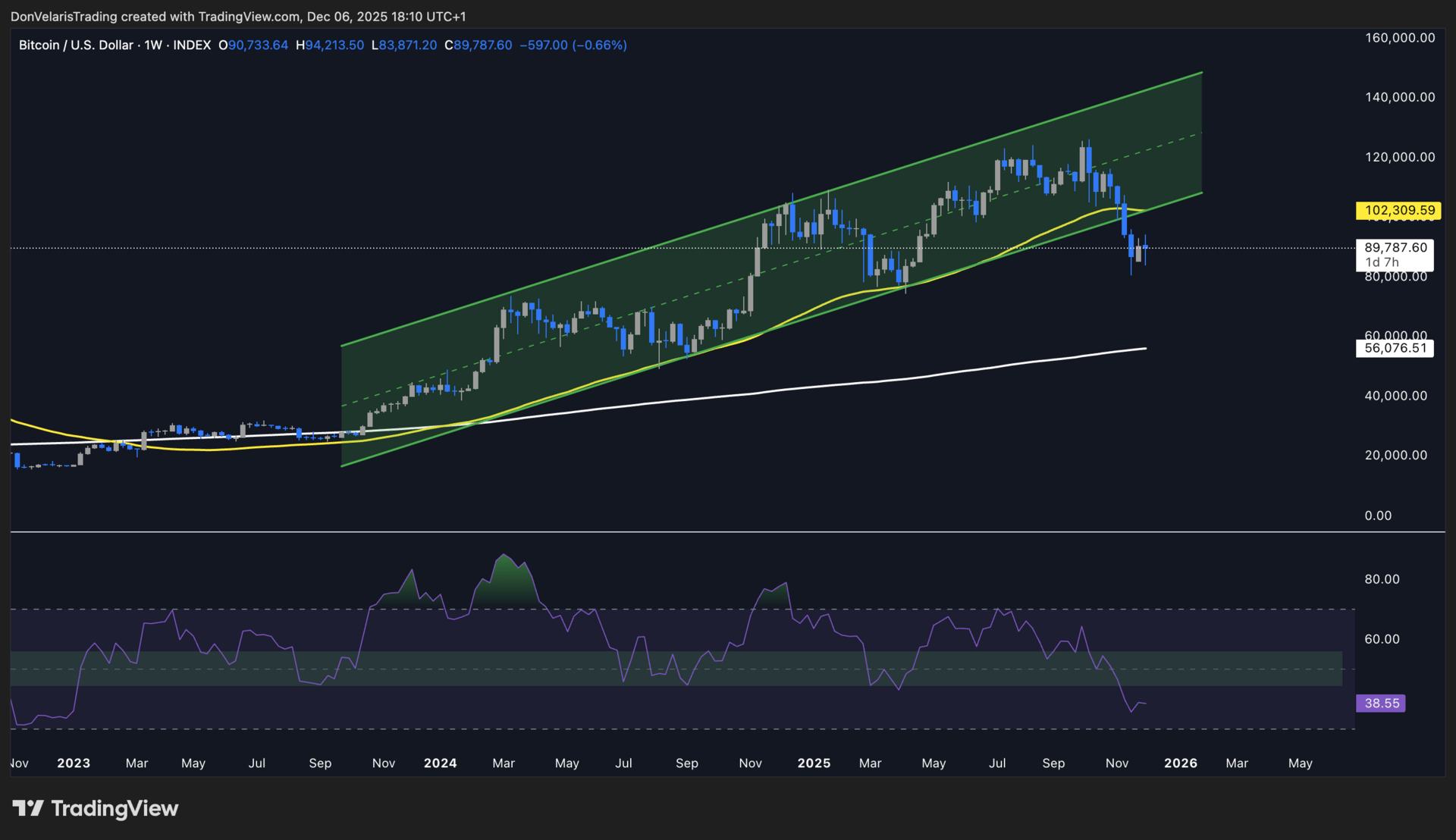

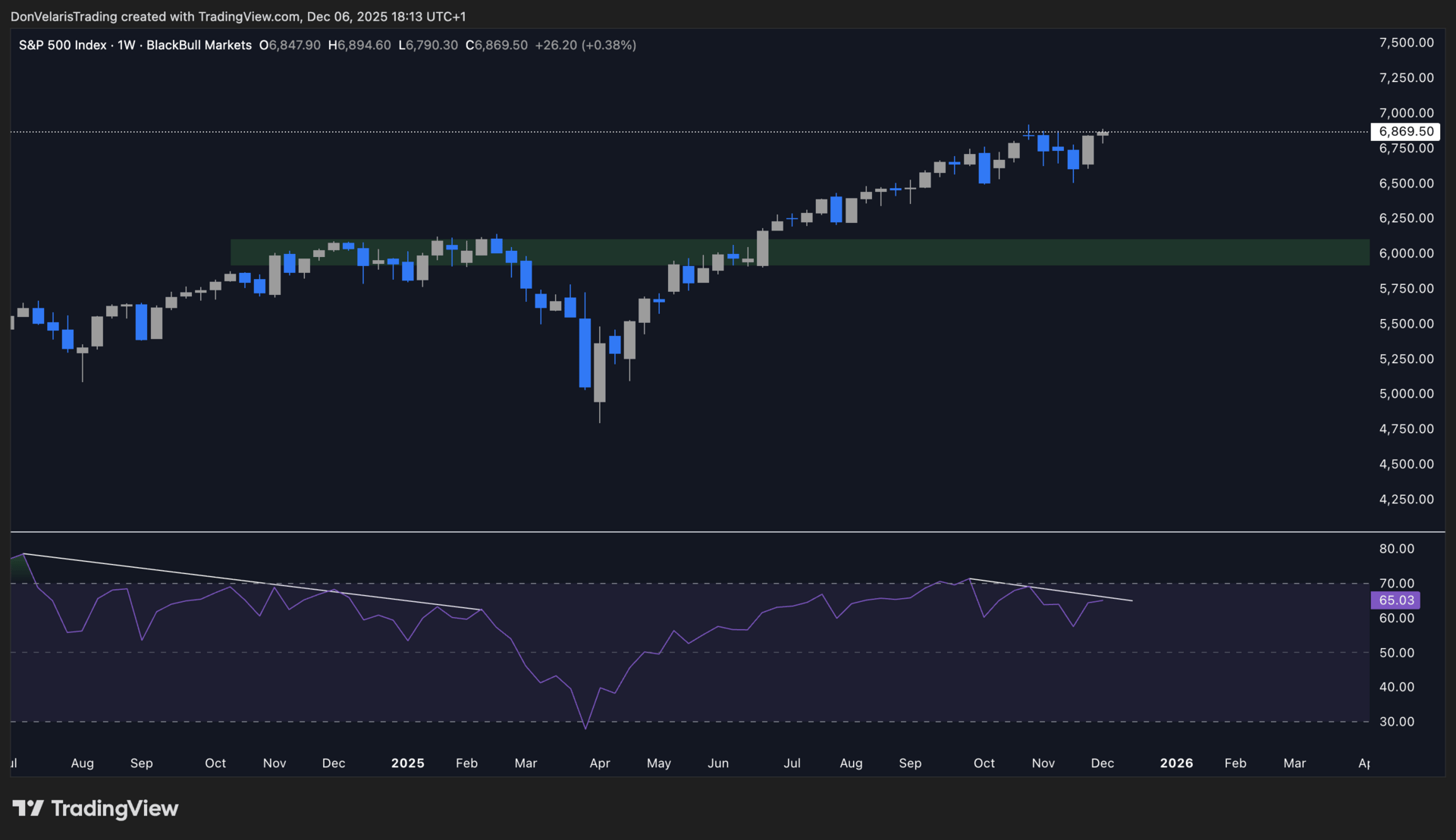

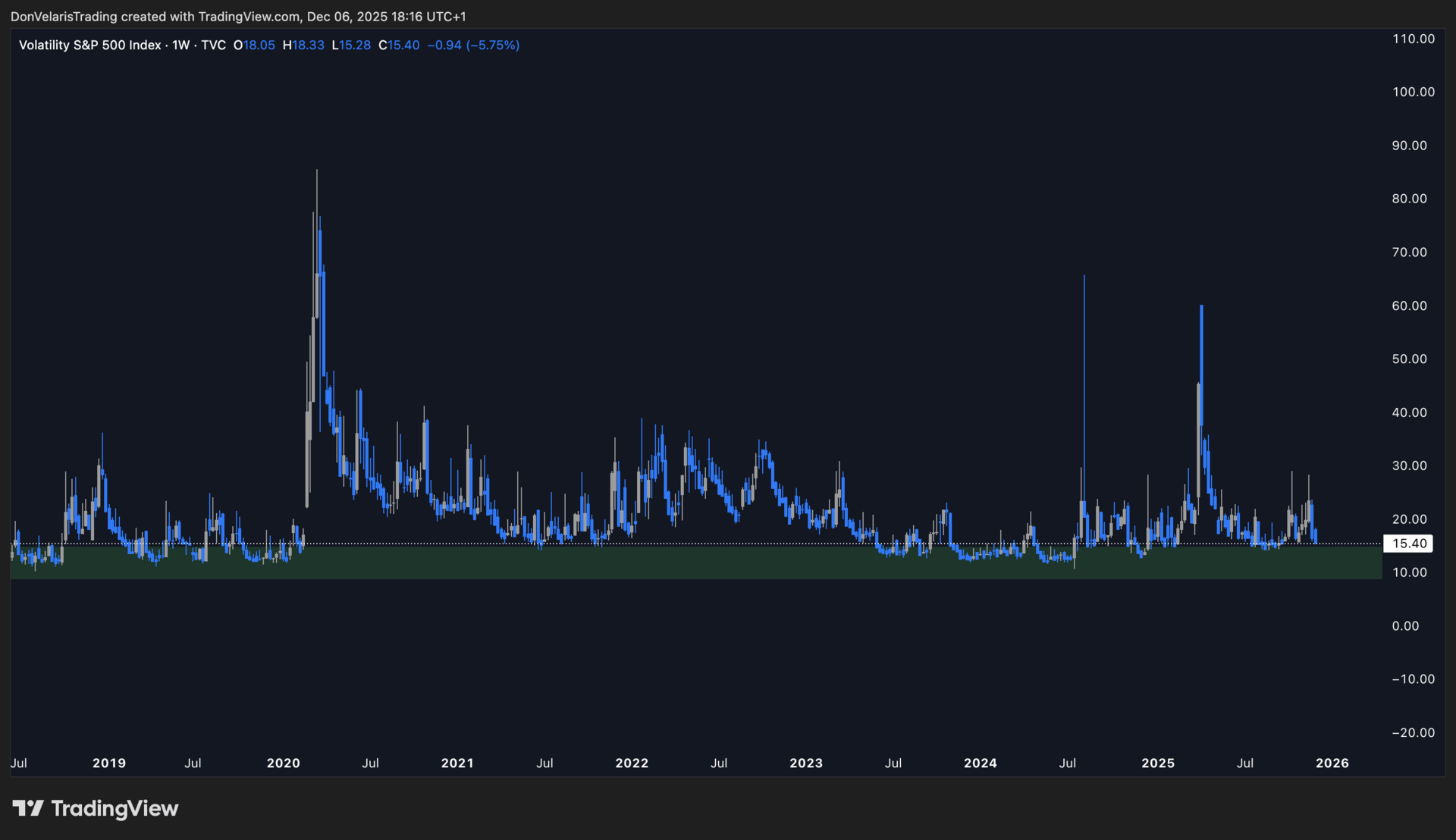

Bitcoin is set to end the week with a 4th consecutive weekly close below the 50-week moving average, below 100K and below the parallel channel that defined the bull market for the past 3 years, reinforcing the structural breakdown that began in September when multi-timeframe bearish divergences signaled the cycle top. Traditional markets recovered from early November weakness and printed a strong weekly close, although momentum is slowing as the S&P 500 is possibly forming divergences with RSI making lower highs while price made higher highs. The VIX moved back toward 15, reflecting rising investor complacency, while the last similar divergence on the S&P 500 in February led to a 20% correction that bottomed on April 7th.

Economic data for the week offered a mixed picture. PCE Prices rose 0.3% month over month and 2.8% year over year, both in line with expectations, while Core PCE increased 0.2% month over month and 2.8% year over year, slightly below forecasts. Consumer Sentiment improved to 53.3, beating expectations of 52.2, with year ahead inflation expectations falling to 4.1% and long run expectations easing to 3.2%. ADP Employment showed a decline of 32’000 jobs, the largest drop in over 2 years and far below the expected gain of 40’000. Initial Jobless Claims dropped to 191’000, a 3-year low, while Continuing Claims decreased to 1’939’000. ISM Services printed 52.6 versus the expected 52.2, and ISM Manufacturing came in at 48.2 versus the expected 49.2.

The Coming Week and What I Look For

Bitcoin

Bitcoin is about to end the week with yet another weekly close below the 50-week moving average, below 100K, and below the green parallel channel that has guided the bull market for the past three years. This marks the fourth consecutive weekly close beneath all three structural levels. At this stage the probability that the cycle is over is extremely high. We identified this already in September, well before the crash, exited the crypto market entirely and shorted the entire move down. The three day, weekly and monthly bearish divergences, combined with additional cycle indicators, made the top very clear.

Bitcoin 1 Week Chart

Despite this, I still expect Bitcoin to move back toward the 50-week moving average at around 102K. Historically, Bitcoin often retests the 50-week moving average after losing it. This move typically serves as a final bearish retest before deeper downside. If Bitcoin reaches 102K or slightly above, that zone becomes a high conviction area to short or, for those who did not take profits earlier, a strong area to reduce exposure.

The two scenarios I am watching remain the same.

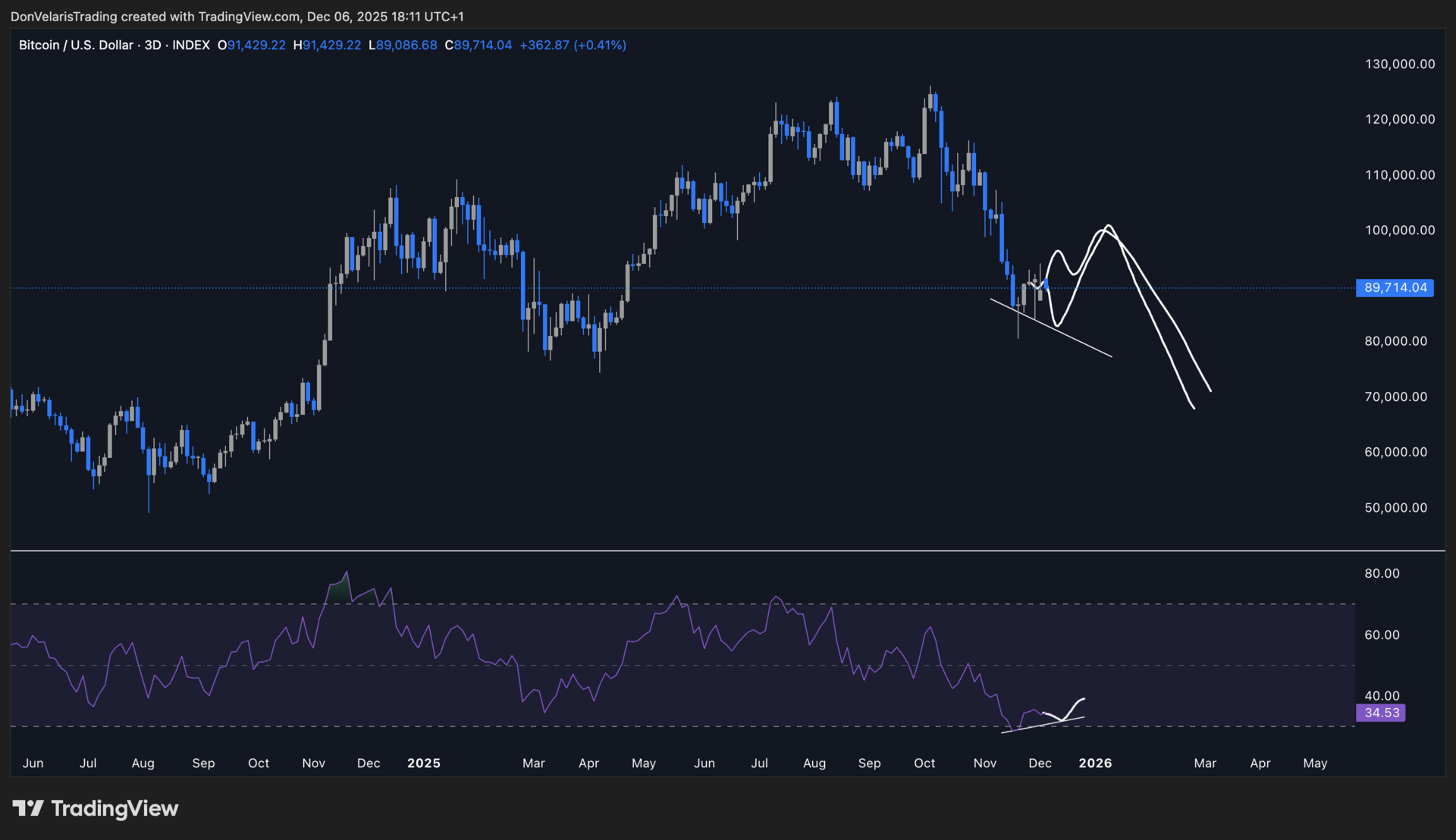

In the first scenario, which I consider more likely, Bitcoin rejects the 94K region. This level is major resistance as it is also close to the yearly open. A rejection there would open the door for a move below 84K where Bitcoin could form a bullish divergence on the one day to three day time frame. This could require Bitcoin to drop into the mid-seventies to properly form a higher time frame divergence. After this divergence forms, Bitcoin would likely return for a bearish retest of the 50-week moving average at around 102K, which also aligns with the upper boundary of the parallel channel that defined the entire bull market.

In the second scenario I expect roughly the same outcome, but faster. Instead of forming a deeper correction before the bearish retest, Bitcoin could flip 94K and go directly to retest the 50-week moving average before continuing lower.

One of these two scenarios can easily unfold next week as we head into the FOMC event.

Bitcoin 3D Chart

Traditional Markets

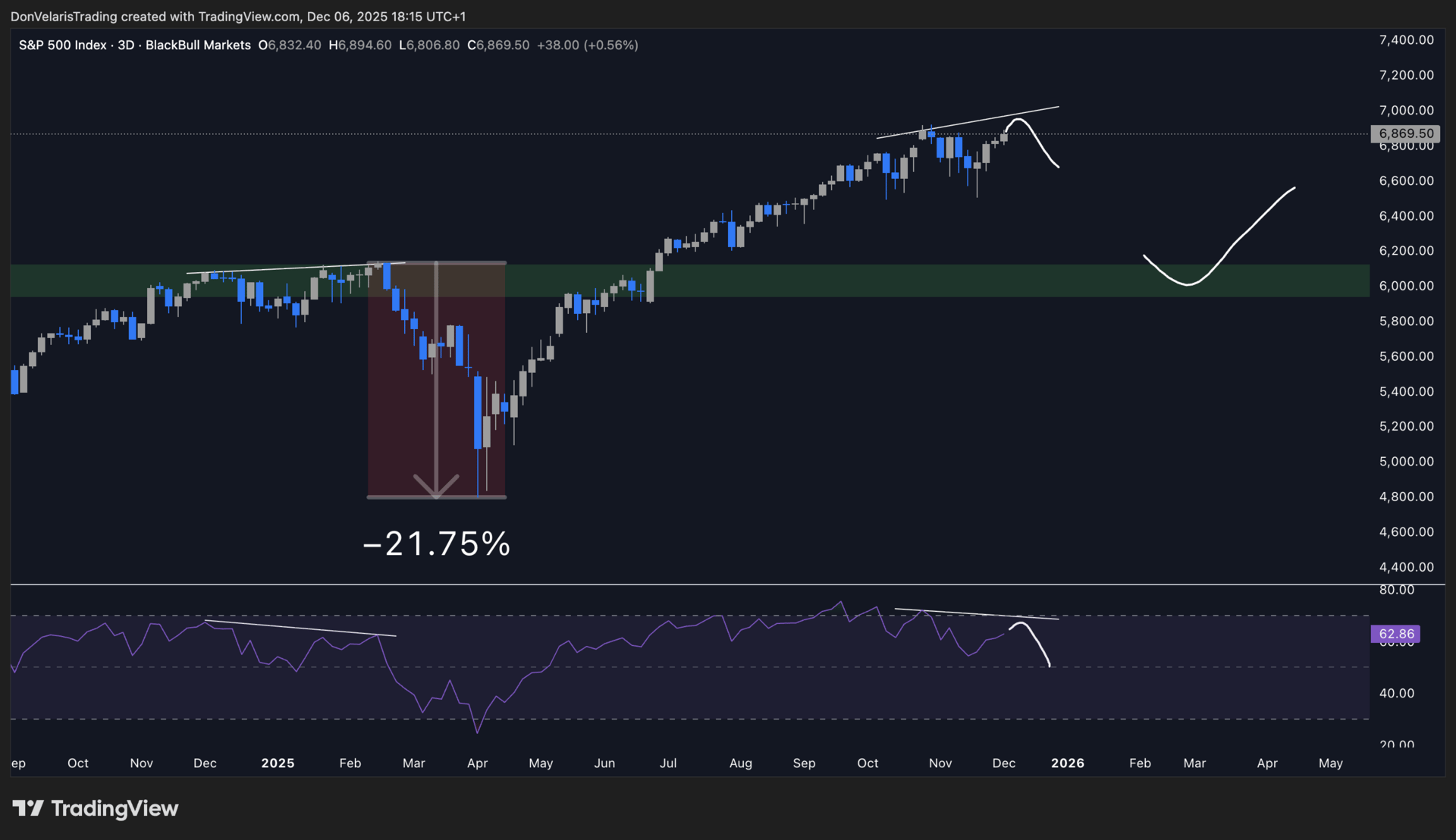

Traditional markets printed a strong weekly close after a period of weakness during the first three weeks of November. The S&P 500 is climbing again, but momentum is slowing. On both the weekly chart and the three day chart the RSI is making lower highs while price makes higher highs, forming a clear divergence. Divergences tend to be less reliable in traditional markets than in crypto, yet they remain important signals to monitor.

SPX500 1 Week Chart

The last time we saw such a divergence was in February, and it led to a 20% correction. We were able to catch that correction perfectly and bought the exact bottom on April seventh.

SPX500 3D Chart

At the same time the VIX is returning to a profit-taking area below fifteen. A low VIX suggests that investors are becoming too comfortable buying, which increases the risk of complacency. Environments with low volatility and high confidence are usually situations where I reduce exposure rather than increase it.

VIX 1 Week Chart

Economy

Next week will be critical. We receive the job numbers which will heavily influence Federal Reserve decisions for Q1 and Q2 of next year. Inflation is rising and the job market is cooling. Historically the Federal Reserve lowers interest rates to support the labor market and stimulate economic activity. However, lower rates tend to push inflation higher.

Because inflation is already rising, the Federal Reserve cannot cut too aggressively. Doing so risks letting inflation accelerate again, creating a situation very similar to stagflation. The current decade reminds me strongly of the 1920s. The economy looked healthy on paper, high earners saw increased income, but the middle class experienced declining buying power and stagnating wages.

By the start of next week we will get ADP and JOLTS labor data. Later in the week the Federal Reserve will hold the FOMC meeting and announce its rate decision on December tenth at two in the afternoon Eastern Time. Markets expect with high conviction a rate cut of twenty-five basis points. This expectation is largely priced in already and is one of the reasons why the Dollar Index has been falling over the past several days.

FOMC December 10th Target Rate Expectations

We will also receive PPI inflation data next week, which I will analyze in detail the day before release.

Calendar

Monday (Dec. 8)

Economic: no reports

Earnings: Compass Minerals International Inc. (CMP), Phreesia Inc. (PHR), Toll Brothers Inc. (TOL)

Tuesday (Dec. 9)

Economic: JOLTS Job Openings, Productivity Revised, Unit Labor Costs

Earnings: AeroVironment Inc. (AVAV), AutoZone Inc. (AZO), Braze Inc. (BRZE), Campbell's Co. (CPB), Caseys General Store Inc. (CASY), Core and Main Inc. (CNM), Ferguson Enterprises Inc. (FERG), GameStop Corp. (GME), Sailpoint Inc. (SAIL)

Wednesday (Dec. 10)

Economic: EIA Crude Oil Inventories, Employment Cost Index, FOMC Rate Decision, MBA Mortgage Applications Index, Treasury Budget, Wholesale Inventories

Earnings: Adobe Inc. (ADBE), Chewy Inc. (CHWY), Daktronics Inc. (DAKT), Hello Group Inc. (MOMO), Nordson Corp. (NDSN), Oracle Corp. (ORCL), Photronics Inc. (PLAB), Synopsis Inc. (SNPS), Uranium Energy Corp. (UEC), Vail Resorts (MTN)

Thursday (Dec. 11)

Economic: Continuing Claims, EIA Natural Gas Inventories, Initial Claims, Producer Price Index PPI, Core PPI

Earnings: Broadcom Inc. (AVGO), Ciena Corp. (CIEN), Costco Wholesale Corp. (COST), Lovesac Co. (LOVE), Lululemon Athletica Inc. (LULU), Netskope Inc. (NTSK), RH Inc. (RH)

Friday (Dec. 12)

Economic: no reports

Earnings: Johnson Outdoors Inc. (JOUT), Zedge Inc. (ZDGE)

Invitation

If you manage a 6-figures or more portfolio, missed the top and want clarity with a structured timing system, make sure to book a 1:1 diagnosis call with me. I will go through your portfolio and situation and see how I can help you.

Book 1:1 call with me here: Diagnosis Call

Kind regards,

Diego Sonderberg

Share this Outlook:

If you find these insights valuable, please share this newsletter with anyone who follows crypto or global markets. Since 2021 I’ve consistently identified major cycle tops and bottoms and aim to make this the most useful market-timing letter you read each week.

Share the following link with friends and family: https://newsletter.sonderbergadvisory.com/

Learn more:

YouTube Channel

X Account