Week 15

Weekly Trader's Market Outlook.

Hey Trader,

Welcome to the weekly Velaris Trading Newsletter – your source for real market insight, no fluff, no noise.

Here’s this week’s newsletter breakdown:

Brief Overview

What’s Coming in Week 15?

After Trump’s massively escalated tariff round and a weak performance in the stock markets, Week 15 is all about the upcoming inflation data. The CPI and PPI reports, along with the Fed meeting minutes, will reveal whether price pressures are truly easing – or if Powell’s warnings are coming true. The market remains in panic mode, but the first signs of stabilization may emerge.

Weekly Market Wrap

Week 14 was a textbook example of a politically driven bear market. The announcement of massive US tariffs against over 50 countries triggered heavy sell-offs – the S&P 500 lost over 17% from its all-time high, and the NASDAQ is officially in a bear market. Only Bitcoin showed relative strength. The labor market is sending mixed signals: more new jobs, but rising unemployment. Powell warned of stagflation, while Trump is demanding rate cuts – a dangerous combination.

Earnings Highlights

This week in focus: Delta Air Lines (DAL), Constellation Brands (STZ), CarMax (KMX), JPMorgan Chase (JPM), Morgan Stanley (MS), BlackRock (BLK)

What does week 15 bring?

Monday, April 7:

Consumer Credit: Expected at $15.2B – an indicator of consumer behavior.

Earnings Reports: Levi Strauss (LEVI), Greenbriar Companies (GBX), Dave & Buster's Entertainment (PLAY)

Tuesday, April 8:

No relevant economic data

Earnings Reports: RPM International (RPM), WD-40 (WDFC), Cal-Maine Foods (CALM)

Wednesday, April 9:

MBA Mortgage Applications, Wholesale Inventories: Expected at 0.3% – potential signal of demand changes.

FOMC Minutes: Insight into the Fed’s monetary policy discussions.

Earnings Reports: Delta Airlines (DAL), Simply Good Foods (SMPL), Constellation Brands (STZ)

Thursday, April 10:

CPI: Expected at 2.6%, Core Inflation at 3.0% – crucial for rate expectations.

Initial Jobless Claims: Expected at 225K

Earnings Reports: CarMax (KMX), Lovesac (LOVE)

Friday, April 11:

PPI: Expected at 3.3%, Core PPI also at 3.3% – an indicator of future price pressure.

Michigan Consumer Sentiment: Expected at 54.5, significantly below last month.

Earnings Reports: JPMorgan (JPM), Wells Fargo (WFC), Morgan Stanley (MS), BlackRock (BLK), Bank of New York Mellon (BK)

IMPORTANT: The expectations of the respective economic data may change in the course of the week. They will be updated in the Discord and will be discussed in more detail.

Weekly Market Wrap

Last week was dominated by geopolitical tensions and monetary policy concerns. The S&P 500 dropped sharply below the critical 5250 level, closing at 5074 – a decline of over 17% from the all-time high. The VIX spiked, and the Fear & Greed Index sits at 4. Retail investors continue to buy while institutions are pulling out capital.

Trump’s tariff package set a new benchmark: 10% base tariff on all imports, 25% on cars, and reciprocal tariffs of 50%. Over 50 countries are affected. China responded with counter-tariffs of up to 34%. The market is now pricing in a real trade war scenario.

Powell gave strong warnings about the impact on inflation and growth but remains cautious. The Fed is waiting for more data. Labor data showed strength with 228K new jobs, but the unemployment rate rose from 4.1% to 4.2%.

Bitcoin held up surprisingly well. While tech stocks suffered double-digit losses in some cases, crypto proved more resilient. Some altcoins tested high-timeframe support levels. This raises the question: did big players rotate into Bitcoin due to the tariffs?

Are you not a member yet?

You’re missing out on daily signals, premium analysis & our trading academy.

Try Velaris Trading free for 7 days → velaristrading.com

Cancel anytime. Full access from day one.

Crypto & Market Outlook

This week is defined by CPI and PPI data. The market is seeking clarity: is price pressure under control, or is a second inflation wave looming, triggered by the tariffs? Official data lags – but Trueflation already shows downward trends.

A decline in CPI and PPI would give Powell and the Fed more room to maneuver. However, the Fed is likely to remain cautious as long as political pressure continues.

Crypto is showing relative strength. If CPI comes in below expectations, it could restore some confidence to the market. Conversely, another inflation shock could drag crypto down as well.

Key Catalysts to Watch

CPI & PPI: The most important week of the month. Every percentage point matters for rate expectations and stagflation fears.

FOMC Minutes: Usually not much new beyond the FOMC statement, but markets will still pay attention.

Michigan Sentiment: If consumers lose confidence, it directly impacts demand and growth.

Trump Tariffs: Their economic consequences could already show up in Q2. The escalation is real.

Bank Earnings: JPM, MS, WFC & Co. offer a first glimpse into the state of the credit markets and consumer health.

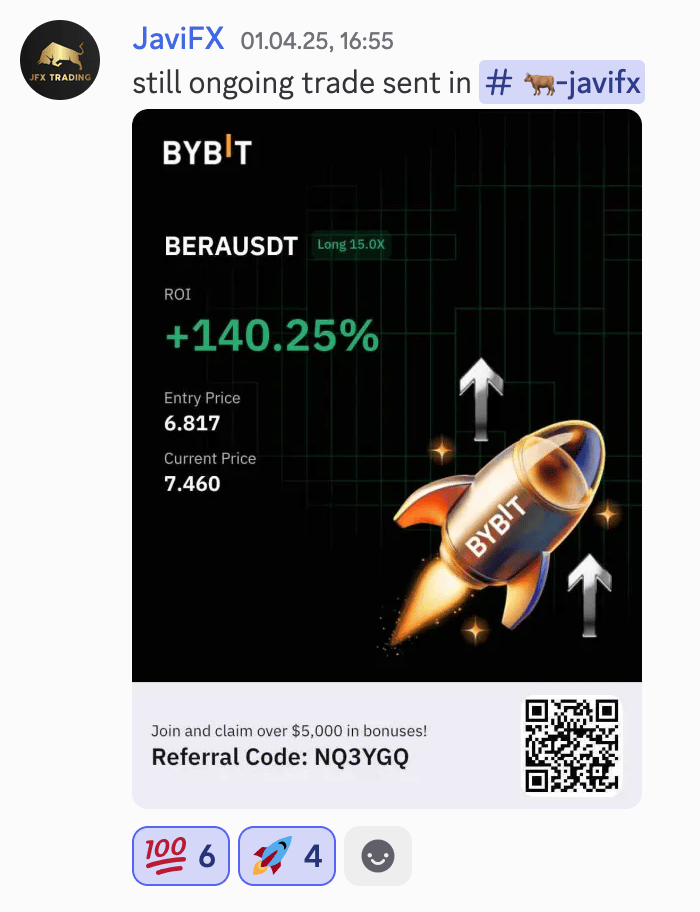

Best trade of the week!

Javi’s BERA long was beautiful.

This week we had a lot of a very good longs and shorts, it was hard to pick a winner!

Conclusion

Week 15 could be a potential turning point. If inflation declines and Powell confirms it, markets could stabilize. If inflation remains high or tariffs escalate further, new lows are possible. These macro signals will be crucial for crypto – both in terms of accumulation opportunities and downside risk.

Key Takeaways

Trump’s tariffs are weighing on global growth.

CPI & PPI could trigger a trend reversal – or deepen the panic.

Powell remains cautious – political tensions are rising.

Bitcoin shows relative strength – altcoins at critical support zones.

Risk management remains the top priority.

Stay sharp!

In our Discord, you’ll find daily detailed market analysis, trading signals, and live updates.

Ask your questions, connect with experienced traders, and learn step by step how to trade and invest independently.

👉 Join for free now → Join here

To a successful week ahead — and stay tuned for more weekly insights into the crypto and financial markets.

Stay focused. Stay rational.

Kind regards,

Don - Founder of Velaris Trading

Membership

Telegram

Website

Support

This newsletter, this e-mail does not contain any financial advice.

Reply