Week 39

Weekly Trader's Market Outlook.

Hey Trader,

Welcome to the weekly Velaris Trading Newsletter – your source for real market insight, no fluff, no noise.

Here’s this week’s newsletter breakdown:

Brief Overview

Weekly Market Recap

Bitcoin held firm above 115K while Ethereum lagged, altcoins stayed mixed, all against a backdrop of Fed rate cuts, record U.S. equities, and easing trade tensions.

What’s Coming in Week 39

Bitcoin hovers in a tight 115K-118K range as markets await Friday’s PCE inflation report, the key swing factor for risk assets and Fed policy.

What does week 39 bring?

Monday, September 22

• No major economic data

• Earnings Reports: Ennis Inc. (EBF), Firefly Aerospace Inc. (FLY)

Tuesday, September 23

• Current Account Balance – reflects net capital flow into the US

• Existing Home Sales – key for housing sentiment and rate impact

• Earnings Reports: AutoZone (AZO), Micron Technology (MU), Worthington Enterprises (WOR)

Wednesday, September 24

• MBA Mortgage Applications Index – early signal on housing demand

• New Home Sales – leading indicator for consumer appetite and real estate

• Earnings Reports: Cintas Corp. (CTAS), H.B. Fuller (FUL), KB Home (KBH), Thor Industries (THO), Uranium Energy Corp. (UEC)

Thursday, September 25

• Advanced International Trade in Goods – key for GDP inputs

• Advanced Retail and Wholesale Inventories – inventory trends reveal demand health

• Durable Goods Orders – expected to be strong, may fuel inflation concerns

• GDP Q2 Third Estimate – expected at 3.3%

• Initial Jobless Claims – forecast at 240K, market will watch for labor softness

• Earnings Reports: Accenture (ACN), BlackBerry (BB), CarMax (KMX), Costco (COST), Concentrix (CNXC), Jabil (JBL), TD Synnex (SNX)

Friday, September 26

• PCE Prices MoM – expected at 0.2 percent, most important inflation metric for the Fed

• Personal Income and Spending – shows consumer resilience or slowdown

• University of Michigan Consumer Sentiment (Final) – expected at 55.9

• Earnings Reports: None

IMPORTANT: The expectations of the respective economic data may change in the course of the week. They will be updated in the Discord and will be discussed in more detail.

Crypto Market Recap: Bitcoin, Ethereum, Altcoins & Smart Money

Bitcoin opened the week near 115.36K and is right now around 116K. It reached a high of 117.91K on September 18 and a low of 114.41K on September 15. Price action respected short-term support near 114K while showing resistance around 118K. A 3 Day bearish divergence is still intact.

Bitcoin 3D Chart

Ethereum underperformed, beginning near 4.52K and is right now around 4.47K. The weekly high came at 4.64K on September 18 and the low at 4.43K on September 16. ETH faced selling pressure near the 4.6K resistance level, while support held above 4.4K.

Ethereum 4H Chart

Major altcoins were mixed. While a few large caps tracked Ethereum lower, the overall market showed resilience, and Bitcoin dominance stayed firm near 57%. This stability indicated a preference for Bitcoin over a broad altcoin rotation.

Smart money activity included a headline purchase from Strategy, the corporate Bitcoin treasury formerly known as MicroStrategy. The firm disclosed on September 15 that it acquired 525 BTC for about 60.2M, increasing its holdings to roughly 639K BTC. On-chain data also revealed ETH whale withdrawals from exchanges, signaling accumulation, though ETH prices still closed the week lower.

Traditional Markets Snapshot

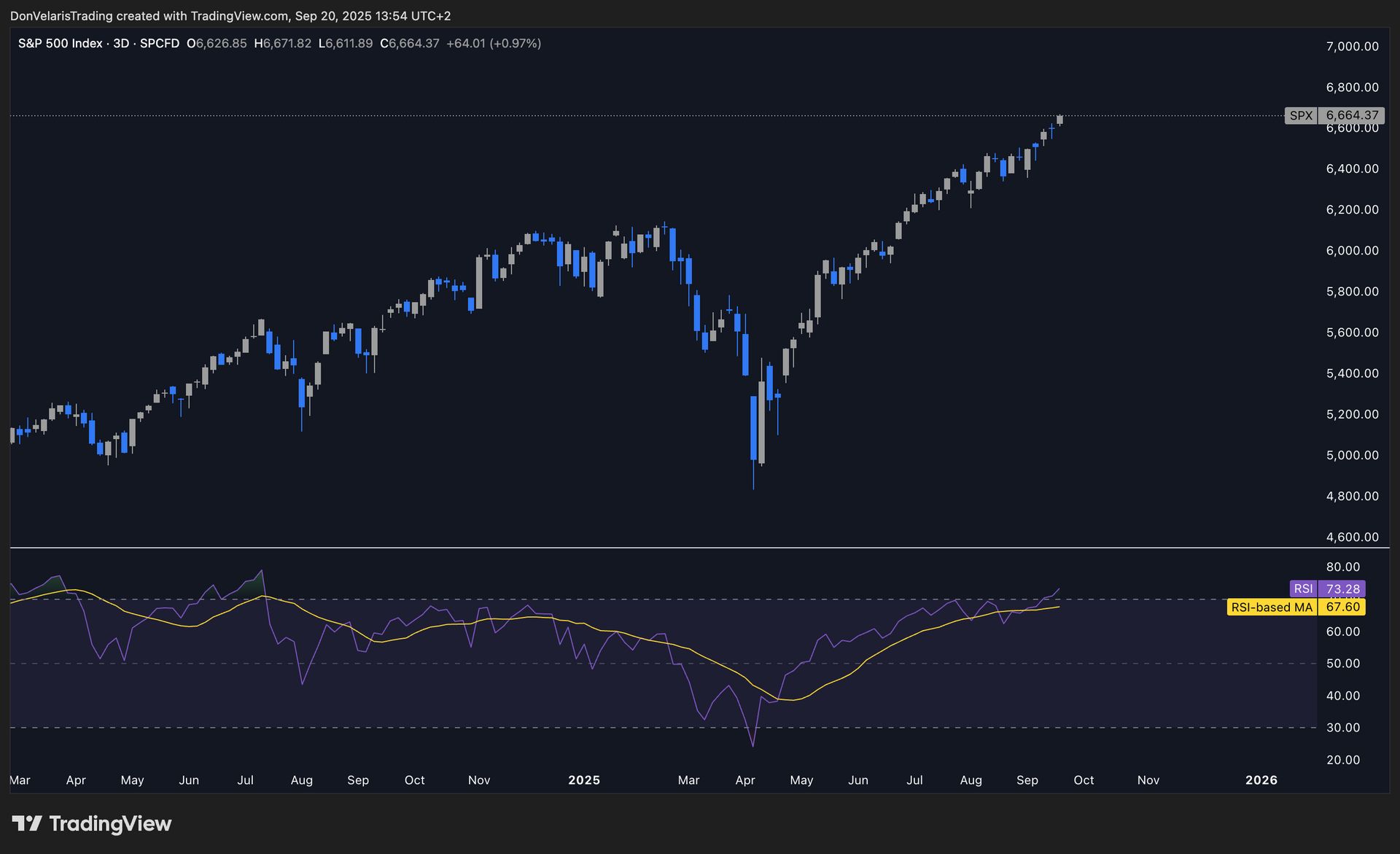

US equities surged to fresh records. The Nasdaq gained 2.2% and the S&P 500 rose 1.2% for the week ending September 19. Semiconductors led the rally after Nvidia announced a 5B investment in Intel and a collaboration on custom chip development. Strong equity momentum provided a supportive backdrop for crypto, even as flows within the digital asset space rotated unevenly.

SPX 3D Chart

Politics & Regulation

In politics, the White House reaffirmed its tariff framework while President Trump held a call with President Xi to ease trade frictions. These developments kept trade policy in focus for markets and contributed to optimism about reduced geopolitical tension. On the regulatory side, no new landmark crypto rulings were announced this week, but ongoing attention from the SEC and CFTC remained part of the broader backdrop.

Federal Reserve & Monetary Policy

The Fed’s September 17 decision to cut rates to 4.00–4.25% was the central event of the week. Powell stressed that the committee remains attentive to labor market risks and left the door open for further easing if conditions warrant. Markets interpreted this as a neutral to slightly dovish shift, fueling rallies in equities and stabilizing Bitcoin above 115K. One governor dissented, favoring a deeper cut.

Are you not a member yet?

You’re missing out on daily signals, premium analysis & our trading academy.

Apply here → velaristrading.com

If you are accepted, you will get full access from day one.

Crypto & Market Outlook

This week is binary. Friday’s PCE inflation report will either revive hopes for a soft landing or confirm that inflation is not dead. The second outcome would pressure both risk assets and the Fed.

Bitcoin remains between 115K and 118K. There is no conviction on either side. Without ETF inflows or macro support, upside will remain limited. A breakdown below 112K could confirm the start of a deeper pullback. To the upside, Bitcoin must break 118K-120K.

Key Catalysts to Watch

PCE inflation on Friday

Q2 GDP revision expected at 3.3%

Micron earnings on Tuesday

USDT Dominance and ETF flows

BTC resistance 118K-120K

Conclusion

The LTF structure looks good for Bitcoin but there is still a big wall that needs to be broken through at 118K-120K. Economy looks fine but the Fed is worried about the labor market while also having to deal with rising inflation. Lowering rates will help the labor market but could also fuel inflation.

In our Discord, you’ll find daily detailed market analysis, trading signals, and live updates.

Ask your questions, connect with experienced traders, and learn step by step how to trade and invest independently.

👉 Try your luck → Apply here

To a successful week ahead — and stay tuned for more weekly insights into the crypto and financial markets.

Stay focused. Stay rational.

Kind regards,

Don - Founder of Velaris Trading

Membership

Telegram

Website

Support

This newsletter, this e-mail does not contain any financial advice.

Reply